Fifth Third Bank Easy Way to Renew Cd

Overview

Fifth Third Bank and its offerings are limited to customers in Ohio, Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, North Carolina, Tennessee and West Virginia. If you live in these areas, you can open an account with this bank online.

If you are able to open an account, your money won't be growing at the highest interest rates in the industry. However, most accounts do earn at higher rates than bigger banks. You'll especially benefit from higher rates if you have the highest account balances possible and open a relationship account.

Read on below to explore Fifth Third Bank's many offerings.

| Product | Key Details |

| Savings Accounts |

|

| Certificates of Deposit |

|

| Money Market Account |

|

| Checking Accounts |

|

Fifth Third Bank Overview

Fifth Third Bank got its name from the merging of Third National Bank and Fifth National Bank, with its very beginnings tracing all the way back to 1858 with the Bank of the Ohio Valley. Despite its limited reach, the bank offers a plethora of financial products and resources. You can find simple savings accounts, auto loans, mortgages, disability insurance plans and more.

The bank and its employees work to improve customers' quality of life through its products and resources. You can find the bank in 10 states: Ohio, Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, North Carolina, Tennessee and West Virginia.

Fifth Third Bank Interest Rate Comparison

Fifth Third Bank Savings Overview

Fifth Third Bank offers a few different bank accounts from the simplest checking account to a high-earning relationship money market account. You can even find specialized checking accounts for students and military members and family members here.

Once you have an account, you'll have access to them online, on mobile, over the phone and at a branch if there is a nearby one. You also have access to over 45,000 ATMs. Plus, the bank can cover the fees that come with using a foreign ATM so you don't have to worry about withdrawing money at an extra cost. You'll also often have access to Identity Alert® and overdraft solutions.

The bank's offerings are limited to customers in certain locations, however, meaning not everyone in the U.S. can open an account.

Compare Fifth Third Bank to Other Competitive Offers

Savings Accounts: Fifth Third Goal Setter Savings® and Fifth Third Relationship Savings

| Key Features | Details |

| Minimum Deposit | None |

| Access to Your Savings Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees |

|

| Current Terms and Rates | Rates based on Ohio zip code 44223

|

The bank's main goal is to help you save efficiently. For starters, the bank's simple savings account Fifth Third Goal Setter Savings® account lets you set savings goals for yourself and track your progress toward those goals. However you can't access your funds unless you visit a branch or by calling the bank at 1-800-972-3030. You'll also receive a one-time interest bonus when you reach your savings goal. This interest bonus appears as a one-time credit to your account and equals the total amount of interest you've earned over the life of your account. Lastly, there are a number of ways you can waive the low monthly fee, which is already automatically waived for the first six months.

The Fifth Third Relationship Savings account boosts your savings with the bank's relationship interest rate when you also have an eligible Fifth Third Checking Account. This account relationship also enables combined account statements and easy transfers. Easier transfers means faster savings, too. You'll also have access to convenient account features like "App, Tap, Deposit®," which allows you to deposit checks via your phone, mobile bill pay and instant alerts.

Savings Accounts: Health Savings Account (HSA)

| Key Features | Details |

| Minimum Deposit | None |

| Access to Your Savings Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees |

|

| Current Terms and Rates | You must visit a branch to find accurate rates. |

A health savings account, or HSA, lets you save for medical expenses. You can access your savings in this account with a Fifth Third Bank Debit Mastercard®, but only to pay for qualified medical expenses. Luckily, the Fifth Third Health Savings Account helps you keep track of your purchases and manage a budget. Features include online bill payment so you can more easily pay your medical expenses to healthcare providers nationwide.

You can access your HSA with the bank's HSA Mobile App. This allows you to view your transactions and balance and securely upload medical receipts. Plus, the account offers the opportunity for mutual fund investments. You can begin participation once you have an account balance of $2,000. Mutual fund participation will cost you an extra monthly fee of $2.

You'll have to visit your local Fifth Third Bank branch to open this account.

Certificates of Deposit (CDs): Promotional CD, Standard CD and 529 CD

| Key Features | Details |

| Minimum Deposit |

|

| Access to Your CD | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

| Current Terms and Rates: Promotional CD | Rates based on Ohio zip code 44223

|

| Current Terms and Rates: Standard CD | Rates based on Ohio zip code 44223

|

The bank has a few CD offerings. A CD grows your initial deposit at the set rate for a set amount of time. You choose the term length you want. The bank offers accounts ranging from seven days to 84 months. Typically, you cannot touch the funds within a CD until the term length is over, also known as reaching maturity. Once a CD reaches maturity, you can renew the account or withdraw your funds.

You can open a 529 CD with the bank, as well. A 529 savings account helps you save for education expenses, like room and board or textbooks. This account won't be taxed while your money grows. Plus, your withdrawals typically won't face federal (and sometimes state) income taxes.

Fifth Third Bank CDs earn more thanks to compound interest. This means that your money is constantly growing since interest earned will earn interest and so on. You also have room to move the earned interest to a Fifth Third checking account or savings account if you don't want to keep it in the CD.

If you want to open a Fifth Third loan and you have a CD with the bank, the CD may be used as collateral for the loan.

You will have to visit a bank branch or give them a call to open a CD.

Money Market Account: Fifth Third Relationship Money Market

| Key Features | Details |

| Minimum Deposit | None |

| Access to Your Money Market Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | $5 monthly fee, waivable with one of the following

|

| Current Terms and Rates | Rates based on Ohio zip code 44223

|

Fifth Third Bank advertises this money market account as perfect for you if you want to see some serious savings growth. It helps if you have a larger amount of money to deposit and grow, with higher balances earning at higher interest rates. This also means that as your money accrues interest, it can climb up the account balance tiers to earn even more interest. Plus, you can earn better Relationship Interest rates when you have a Fifth Third Checking Account, too.

As a kind of cross between a standard savings account and a checking account, this money market account includes the ability to write checks.

Checking Accounts: Fifth Third Essential Checking®, Fifth Third Enhanced Checking® and Fifth Third Preferred Checking® Accounts

| Key Features | Details |

| Minimum Deposit | None |

| Access to Your Checking Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fifth Third Essential Checking® Fees |

|

| Fifth Third Enhanced Checking® Fees | $20 monthly fee, waivable with one of the following

|

| Fifth Third Preferred Checking® Fees | $25 monthly fee, waivable with a combined total balance of at least $100,000 in deposit and investment accounts per month |

| Current Terms and Rates | Rates based on Ohio zip code 44223

|

The Fifth Third Essential Checking® account provides you with the essential features of a checking account at a low monthly fee of $8 or $11, depending on the monthly balance you maintain or the monthly direct deposit totals you make. (See details above.) This includes a debit card which you can use at ATMs and branches to access your account and unlimited check writing abilities. You'll also have access to your account through online and mobile banking, where you can view statements, pay bills and make deposits. Plus, having this account gives you access to better rates on a Fifth Third savings account.

The next step up is the Fifth Third Enhanced Checking® account. It comes at a higher minimum monthly fee of $20, although you can get it waived in one of two ways: either by maintaining a combined monthly balance of $20,000 in deposit and investment accounts or by making total monthly direct deposits of at least $5,000. For that price, you can snag better rates on CD accounts, Fifth Third loans and other savings accounts. You'll have to visit a branch or call the bank to open this checking account.

Then comes the Fifth Third Preferred Checking® account which has a slightly higher monthly fee than the Enhanced Checking® account. It fee is $25. The requirement to waive the fee is even higher: You'll need to maintain a combined monthly balance of $100,000 in deposit and investment accounts. This highest tier account comes with all the perks of previous accounts, plus complimentary Identity Alert® and a discount on Identity Alert Premium®. This feature provides single bureau daily credit monitoring, monthly triple bureau credit reports, CreditXpert® credit scores, Social Security monitoring and up to $25,000 identity theft insurance. Further perks include free checks, notary services, money orders, cashier's checks and a 3x5 safe deposit box. However, you'll have to visit a branch or call the bank to open this checking account.

Checking Account: Fifth Third Express Banking® Account

| Key Features | Details |

| Minimum Deposit | None |

| Access to Your Checking Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees | None |

If you're not interested in too many extra bells or whistles with your checking account, you may want to check out the Fifth Third Express Banking® account. There's no monthly service charge, balance requirement or overdraft fees, but keep in mind this is a very bare-bones account. You can't even write checks or deposit checks at an ATM. For that, you'll have to visit a branch location.

Checking Accounts: Fifth Third Student Banking and Fifth Third Military Checking

| Key Features | Details |

| Minimum Deposit | None |

| Access to Your Checking Account | Online, mobile, over the phone and physical branches. |

| Security | FDIC insurance up to the maximum amount allowed by law. |

| Fees |

|

The bank also offers two specialized accounts for students and military members and families, respectively. The Fifth Third Student Banking account comes with the same terms and benefits as the Essential Checking® account. However, students get to avoid a monthly fee if they're at least 16 years old and have a valid student ID. They also benefit from five free non-Fifth Third ATM transactions per month, making accessing money easier for busy students.

The Fifth Third Military Checking account is available to military families, active duty, retired, reserve/guard and veterans and commissioned officers of the Public Health Service and the National Oceanic and Atmospheric Administration. You can waive the monthly fee in a few different ways with this account. But if this specific arrangement doesn't work for you, you can choose another checking account and receive a $5 discount on that monthly fee. You will also benefit from special VA Home Loan rates and 10 free non-Fifth Third ATM transactions per month.

Where Can I Find Fifth Third Bank?

You can find the bank online, on mobile, at more than 45,000 ATMs and at hundreds of locations in the following 10 states: Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, North Carolina, Ohio, Tennessee and West Virginia.

What Can You Do Online With Fifth Third Bank?

There's a lot you can do online with Fifth Third Bank. For starters, you can explore its many financial offerings from the accounts above to investment opportunities. The bank's homepage, shown here, gives you easy access to personal, small business and commercial accounts. You can also learn more about the bank, its investment options and log in to your existing account here. You can open many accounts online, too.

It may be hard to find the bank's rates for your area online, though. To find an account's interest rates, you have to enter your zip code.

Once you have an account, you can login and access your money online (except with a Fifth Third Goal Setter Savings® account). You'll be able to make transfers, pay bills and set up account alerts. Plus, the bank's mobile app includes these features as well as mobile deposit abilities.

How Do I Access My Money?

You can access your money wherever you can find the bank. This means online, on the bank's mobile app, over the phone, at a local branch or at an ATM. Luckily, there are over 45,000 ATMs across the country you can access.

If you're banking online, you just need to log in with your online banking information to access your account(s). Then you can transfer money, pay bills, make deposits, etc. The same goes for your mobile app.

How Can I Save More Money With a Fifth Third Bank Account?

You can save at the highest-earning rates the bank can offer by opening a Fifth Third Promotional CD. At 12, 36 and 53 months, these accounts have the highest rates. If you want a more fluid account, you can open a Fifth Third Relationship Money Market account with relationship rates. This will grow your money at better rates, especially with higher balances.

You can also save by avoiding the monthly service fees that come with most of the bank's accounts. Each account has a few different ways to waive the fee, like keeping a certain balance or opening another account.

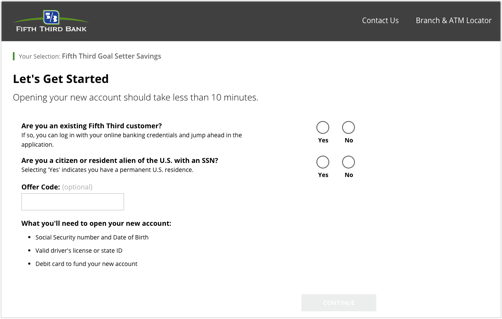

What's the Process for Opening an Account With Fifth Third Bank?

You can apply for most accounts online. This process typically takes 10 minutes and starts with the page shown here. However, not everyone can open an account, unless you open an account from the 10 states the bank has locations. For example, SmartAsset was unable to open an account online at the time using our NYC zip code. However, the bank encourages the applicant to visit a branch instead if you can.

If you are able to open an account, you'll need to provide information including your Social Security number, date of birth, driver's license and a debit card to fund your account.

A number of accounts do require you to call the bank at 1-866-671-5353 or visit a branch in person right off the bat, without the option of opening online. These accounts include CDs, a couple checking accounts and the HSA.

What's the Catch?

The catch is that not everyone in the U.S. can open a Fifth Third account. You can only open an account if you live in the 10 states that the bank has branches in.

The bank also doesn't offer the highest interest rates across the board. There are some accounts, like CDs and the Relationship Money Market Account that do earn at pretty high rates. But to get the best rates, you'll need high account balances and more than one account. These rates come automatically at other banks.

Bottom Line

Fifth Third Bank offers standard rates when it comes to savings accounts, falling on the lower side of the spectrum. You can find the higher rates at this bank with a CD or a Relationship Money Market account with relationship rates. Even with the money market account, you'll have to maintain large account balances to qualify for the best rates.

Save more with these rates that beat the National Average

- Savings & MMA

- CD's

Source: https://smartasset.com/checking-account/fifth-third-bank-banking-review

0 Response to "Fifth Third Bank Easy Way to Renew Cd"

Post a Comment